When Do You Have To Issue 1099 Misc For Rental Repairs

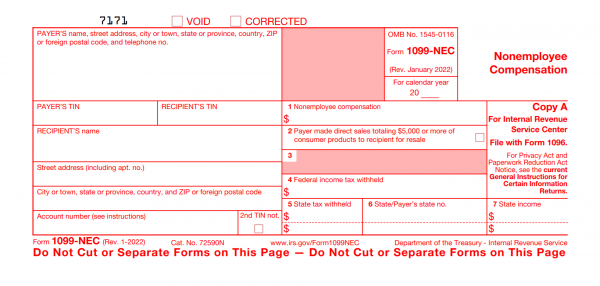

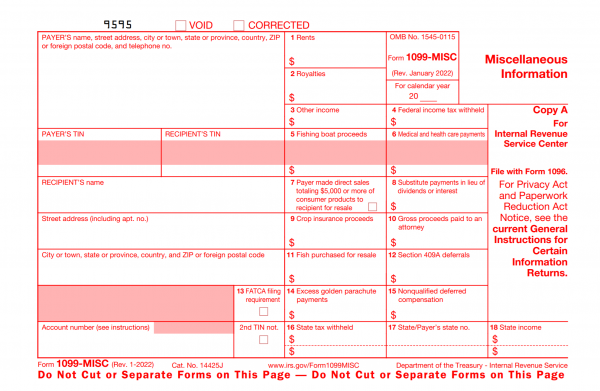

Important Annunciation | The IRS inverse the 1099 MISC and reintroduces the newly required 1099 NEC form last tax flavour and those changes are still in effect. A variety of changes have been implemented, merely almost notably the 1099 NEC course has been resized and the calendar year is at present a fillable field (see screenshots below).

End of yr bookkeeping tasks are one of the biggest stressors for property managers and that includes getting prepared for sending out 1099s.

Last twelvemonth, the IRS has made significant changes to the 1099 forms and deadlines; from changing the 1099 MISC form to reintroducing the 1099 NEC (nonemployee compensation) form.

Every bit the IRS requires property managers to upshot a 1099 taxation form to owners, contractors, and professionals who received more than $600 related to rental business action, it's important to know the details of those form changes, deadlines, and requirements.

What is a 1099 and Why Does the IRS Need Them?

The IRS relies on 1099s to monitor exterior and miscellaneous income sources that are not recorded on a traditional Due west-two grade which reports on salaries and wages. This means that 1099s are a way for the IRS to capture independent contractors or holding owner's income that might otherwise go unreported. While a property possessor or independent contractor is required to honestly report all earnings, the IRS relies on you to assistance reinforce the required income reporting information.

1099 Reporting Related to Belongings Direction

For nearly 3 decades, the 1099 MISC was the merely grade to written report all payments of $600 or more than to owners for rents received and for the work service providers performed related to the rental business. Still, concluding twelvemonth the IRS decided to revive t he 1099 NEC (nonemployee compensation form) and subsequently revamped the 1099 MISC which in essence separates out those two groups.

Who Gets a 1099 Form?

1099 NEC Form

Employ this grade to report payments of $600 or more to gig workers, independent contractors, unincorporated service providers, and vendors (individuals or LLCs) that performed work for you related to the rental concern. This can include:

Repairmen

Plumbers

Carpenters

Landscapers

HVAC professionals

Locksmiths

Cleaning services

COVID-related services such as sanitizing services

Current 1099 NEC Grade Design

1099 MISC Form

The 1099-MISC course in that location are two reasons a belongings management company or landlord will utilise the 1099 MISC form is to report payments of over $600 in a agenda year for:

- Hire sent to owners (owner disbursements, likewise chosen owner distributions) and

- Attorney fees such as to handle an eviction or collect unpaid rent (fifty-fifty if the legal services were provided by a corporation).

The Redesign Changes

In add-on to other 1099 changes, in relation to property management, the following 1099 MISC boxes inverse according to the IRS:

- Written report gross proceeds to an attorney in box 10.

- And for those submitting combined federal and state forms, box 15 is to report state taxes withheld, box xvi is the country identification number, and box 17 is for the amount of income earned in the state.

Current 1099 MISC Form Pattern

Specia l Note : Because of the 1099 changes last year, if you are backside in filling out the previous years 1099s, be sur eastward to contact your accountant and/or the IRS for detailed instructions.

1099 Filing Exemptions

No need to file a vendor or owner 1099 when the payments in a calendar year total less than $600 or were made to buy goods not services. In add-on, there are a few additional exceptions to the 1099 requirements for property managers

1099-MISC Exception : 1099s demand not be filed if the rental property owner is a corporation. This ways if a corporation owns the rental belongings, y'all practice not need to submit a 1099 MISC course to document possessor distributions sent to the corporation.

*This exception only applies if the property (or holding portfolio) has been set up as a corporate entity. Information technology does not employ to chaser fees paid to a legal corporate entity. Attorney fees over $600 require to exist submitted on a 1099 MISC class regardless of business structure.

1099-NEC Exception : Payments to an incorporated business concern who perform maintenance, repairs, or other services related to a customer'due south rentals are exempt from receiving a 1099-NEC grade.

Important Notation: The IRS has circuitous rules and with that, the exceptions higher up take exceptions and nuances that go beyond the telescopic of this article. For example. a vendor operating equally an LLC can opt to be treated as C or S corporation for taxation purposes and and then is likewise exempt from receiving 1099s in many cases. To be sure you are offering 1099s appropriately, exist certain to check current IRS instructions, consult a revenue enhancement counselor, and accept current W9s on file to aid you determine if the company is exempt or not.

Helpful Resource: 2022 Instructions for Forms 1099-MISC and 1099-NEC

What Information Do I Need to File 1099s?

For each individual or entity that yous intend to file a 1099 for, you will need their:

Tax ID Number | For individuals, this is their social security number (SSN), for businesses, it'southward their employer identification number (EIN).

Accost | This allows yous to send the recipient a required re-create for their tax reporting requirements.

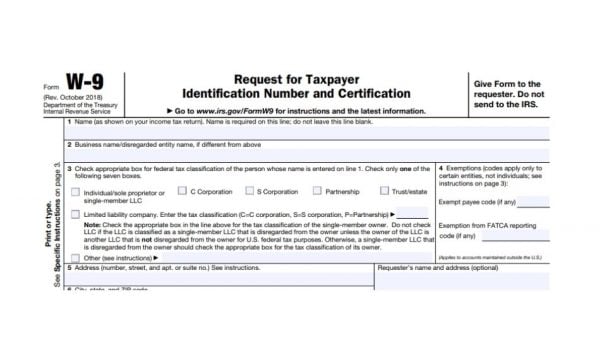

Funds Paid | You lot will need to know the cumulative amount of coin issued to the individual during the revenue enhancement year. Your owners' and vendors' tax ID number and address can be captured via a Due west-9 form . A West-nine class is an official IRS document used to askingand certify a taxpayer's identification number and accost. 1099 Time-Saving Tips

1099 Time-Saving Tips

- It is always a good idea to require a vendor or owner to fill out a W-9 when yous get-go engage in business with them then you practise not have to scramble for this information come up tax reporting time.

- Asking for an updated W-9 yearly volition ensure you always have their most current accost and data and aren't caught surprised by whatever changes in their business.

- It'southward non as well tardily to send a W-9 to owners and vendors earlier 1099s are due. IRS West-9 data, instructions, and .pdf form can exist establish here: About Course W-ix

1099 Requirements for Rental Owners

If you self-manage the rental property you own, you may wonder virtually your 1099 requirements. Back in 2009, a clause in the Affordable Intendance Act required rental owners to report 1099-MISC income paid to service providers in relation to the rental holding. In 2010, the clause was further clarified with the Small Business Jobs Act and the Health Care Reform Neb. Just, by 2022 the requirement was repealed , making it non necessary for private landlords to file 1099s to vendors for work related to their own rental property.*

*That said, the penalties for declining to file 1099 tax documents are high, so you should e'er speak with a tax professional who is familiar with rental existent estate tax requirements if you take whatever questions or require further clarification.

When are 1099s Due?

*State deadlines vary

Federal 1099-NEC Deadlines

Both the IRS and recipients must receive their corresponding copies (regardless or filing by paper or electronically) on or earlier Jan 31, 2022.

Federal 1099-MISC Deadlines

The 1099-MISC copy must achieve the IRS and recipient on or before Feb 28, 2022 if paper filing, or March 31,2022 if you lot file electronically. Notation: If you report any amounts in box viii or 10, the borderline is February fifteen, 2022. This also applies to statements furnished as role of a consolidated reporting argument.

More than information on due dates can be found on the Guide to Information Returns on page 26 of this IRS publication | 2022 Full general Instructions for Certain Information Returns

Remember, the penalties for failing to file 1099s tin can be plush and so it is important to understand your obligations when it comes to 1099 requirements for your rental business concern. It's always recommended that you speak with your accountant or a tax professional with specific questions nearly your taxes and upcoming deadlines.

How practice I File 1099s for my Belongings Management Business?

Every bit both the 1099 MISC and 1099 NEC have different IRS filing deadlines and even so those deadlines are different from when the recipient must receive them, it can become complicated to coordinate that timing.

The simplest fashion to file your 1099s with the IRS and ship them out to recipients is to do and so electronically, or e-file.

Of course, yous as well have the option to mail 1099 Tax Forms to the IRS, all the same, whatsoever business organisation that submits more 250 1099-MISC Forms must file electronically.

Property management software makes it easy for property managers to consummate 1099s and run into your tax reporting requirements. Your property direction software should always accept integrated accounting features that records owner and vendor payments fabricated throughout the year and will generate piece of cake-to-read reports summarizing your vital tax reporting data.

The right software will provide you with a way to file your reports online from your account (east-file) or impress out a revenue enhancement assistant report to give your CPA or apply for manually filing 1099s.

Want to use Rentec Direct to electronically file your 1099 taxation documents? It's like shooting fish in a barrel with the 1099 Revenue enhancement Assistant and integrated e-file functions. Belongings managers and landlords tin can observe user-friendly e-filing options for 1099s within their rental direction software.

Through services similar Rentec Straight, 1099s are automatically generated based on your financial records and vendor payments recorded throughout the twelvemonth, so sending 1099s to recipients and filling them with the IRS is a cakewalk.

This updated article originally posted 12/04/2020 and is to help understand the 1099 changes and does not constitute legal advice. Delight consult with your tax professional person regarding your 1099 obligations and deadlines.

RELATED READING FOR Yous:

- Landlord 1099 Requirements | What is a 1099 and Do I Demand to File

- Revenue enhancement Tips for Rental Properties & Rental Income and Deductions for Landlords

- Rental Holding Bookkeeping Tips and Tricks for Landlords and Belongings Managers

When Do You Have To Issue 1099 Misc For Rental Repairs,

Source: https://www.rentecdirect.com/blog/1099-nec-and-1099-misc-changes-and-requirements-for-property-management/

Posted by: hughesmishe1955.blogspot.com

0 Response to "When Do You Have To Issue 1099 Misc For Rental Repairs"

Post a Comment